Odoo 17 introduces a powerful feature—Sales Credit Limit—designed to help businesses efficiently manage customer credit and reduce financial risk. Whether you're extending payment terms or managing multiple open invoices, this tool gives you full visibility and control over customer credit exposure.

Activating the Sales Credit Limit Feature in Odoo 17

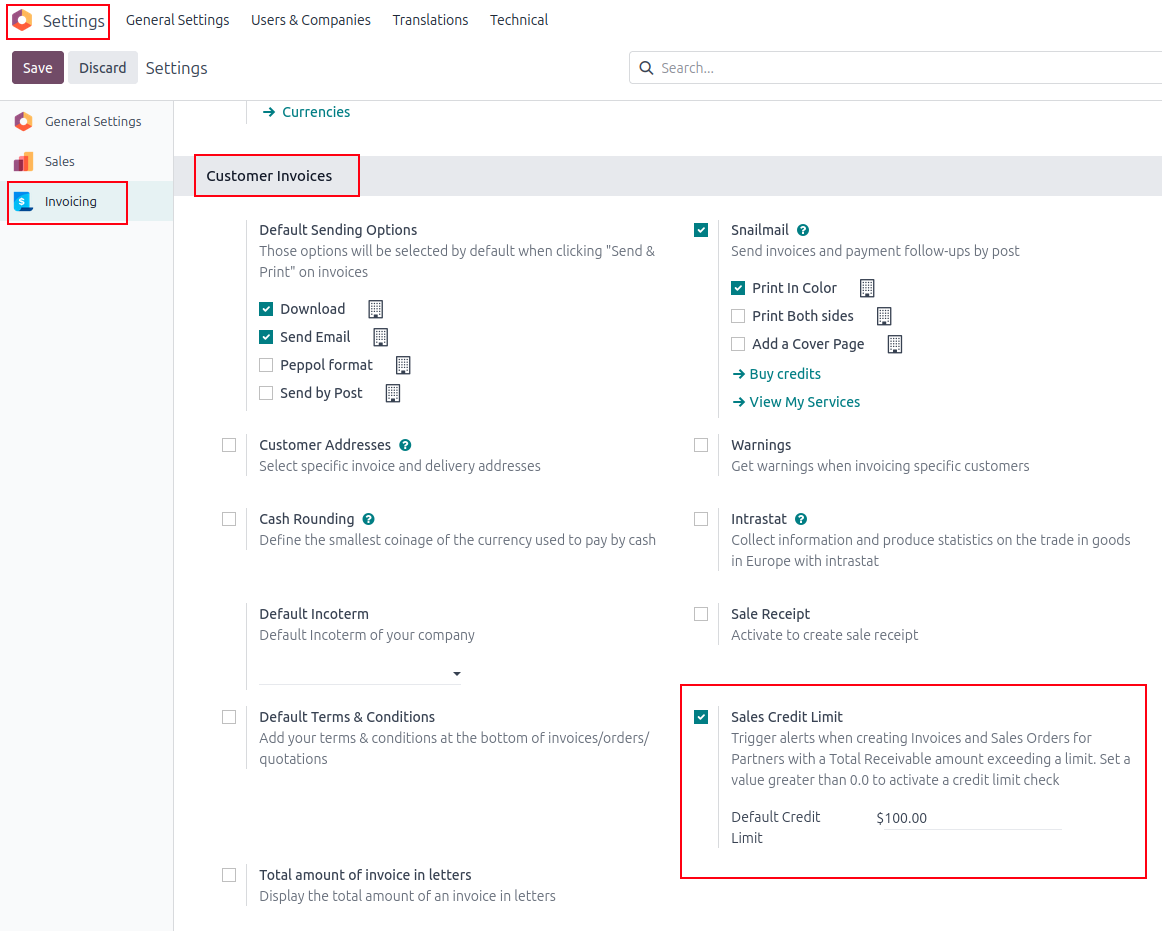

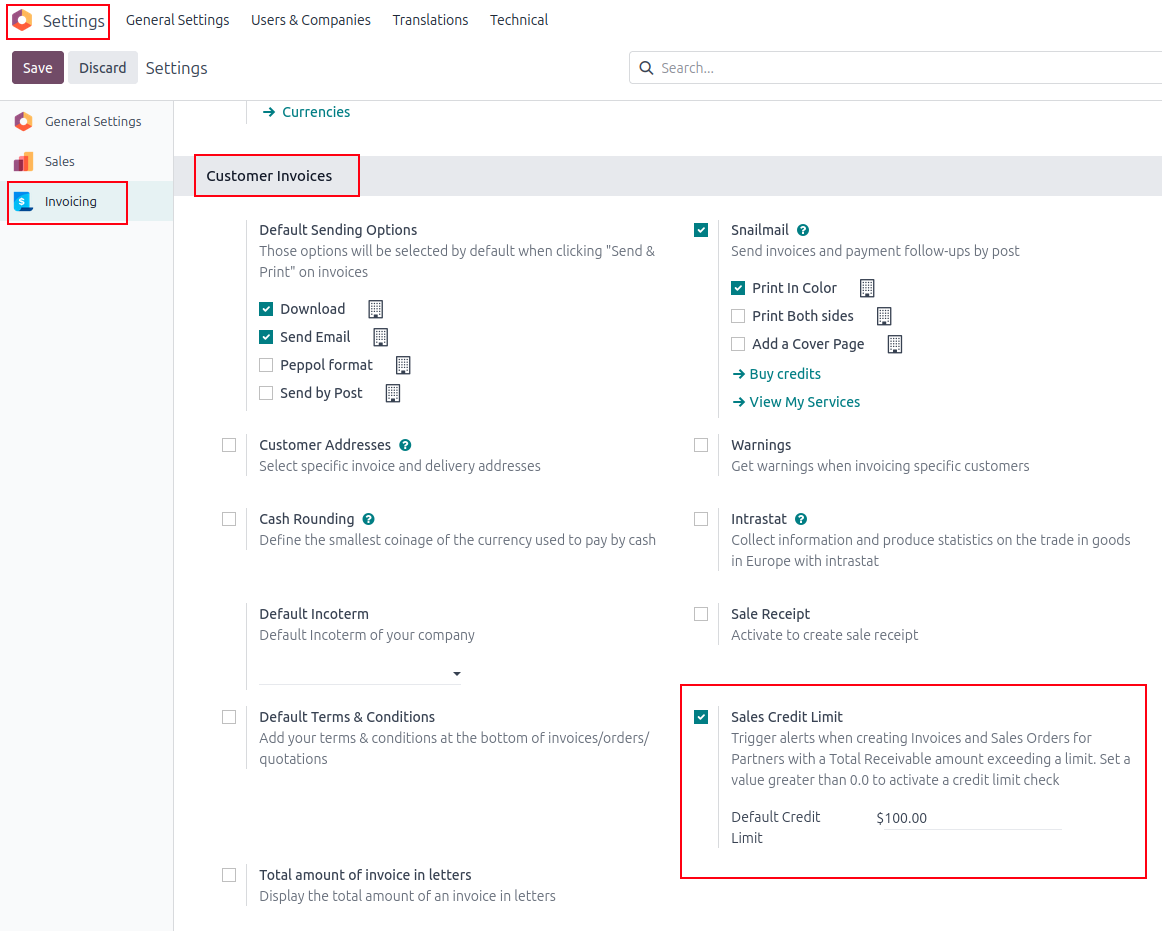

To get started with managing credit limits:

- Go to Accounting > Configuration > Settings.

- Scroll to the Customer Invoices section.

- Enable the checkbox for Sales Credit Limit.

- (Optional) Set a Default Credit Limit that applies automatically to all new customers.

This activation ensures that credit control is enforced across your sales orders and invoices, helping your team stay alert to credit thresholds.

If you're exploring ERP options, start with our Odoo consulting services in Australia to get expert advice tailored to your business.

Setting Customer-Specific Credit Limits in Odoo

Once the feature is active, you can define individual credit limits for each customer:

- Open the Contacts app and choose an existing customer or create a new one.

- Navigate to the Invoicing tab.

- Enable Partner Limit.

- Set the Credit Limit value based on your payment policy or risk profile.

💡 This limit represents the total amount a customer can owe. If new transactions push them over this threshold, Odoo will issue a warning

We help you achieve digital transformation through end-to-end Odoo implementation tailored to your business.

⚠️ How Credit Limits Affect Sales Orders and Invoices

When creating a Sales Order or Customer Invoice, Odoo will check the customer's outstanding balance in real-time. If the total due exceeds their credit limit:

- A warning message will appear to notify the user.

- The alert includes the current due amount and the credit limit set.

- Users can still proceed with the transaction, but now with full visibility of the credit overage.

📝 This “soft control” method is ideal for companies that want to encourage financial discipline without hard blocks in the sales workflow.

Ensure system reliability with our ongoing Odoo support and maintenance services.

💡 Why You Should Use Sales Credit Limits in Odoo 17

Implementing Sales Credit Limits is a smart move for businesses that manage post-paid transactions. Here’s why:

- Prevent excessive credit exposure

- Minimize the risk of bad debts

- Encourage timely customer payments

- Enable real-time monitoring for sales and finance teams

- Maintain healthy cash flow

Thinking of switching platforms? Start your safe migration from legacy systems to Odoo with confidence.

Final Thoughts

With just a few simple configurations, Odoo 17’s Sales Credit Limit empowers your business to enforce smarter credit policies. Whether you're working with long-term clients, wholesale buyers, or B2B partners, this feature ensures your team is always aware of financial boundaries before approving a sale.

Start using Odoo 17 Credit Limit today to boost your credit risk management strategy, improve cash flow, and protect your bottom line.