Managing accounting tasks can be a daunting challenge for businesses, especially as they grow. Simplifying your accounting processes not only saves time but also enhances accuracy, reduces errors, and allows you to focus on more strategic aspects of your business. In this guide, we’ll cover 6 essential steps to help you streamline your accounting and ensure financial precision.

1. Automate Repetitive Accounting Tasks

Automation is key to reducing manual workload and minimising the risk of errors. Using accounting software like QuickBooks, Xero, or FreshBooks enables you to automate routine tasks such as invoicing, payroll, and expense tracking.

- Benefits:

- Reduced human errors

- Time-saving on repetitive tasks

- Timely financial reporting

- Enhanced workflow efficiency

Pro Tip: Automate recurring invoices and payment reminders to ensure timely payments from clients and improve cash flow management.

2. Adopt Cloud-Based Accounting Software

Switching to cloud-based accounting platforms is a game changer for businesses. Solutions like Xero, Odoo, or Zoho Books allow you to access your financial data from anywhere, collaborate with your team in real-time, and ensure your data is always up to date.

- Benefits:

- Remote access to financial data

- Real-time updates

- Simplified collaboration with accountants

- Reduced dependency on physical documents

Pro Tip: Choose a cloud accounting software that integrates seamlessly with other tools you use, like CRM or project management systems, to centralise your operations.

3. Standardise Your Chart of Accounts

A standardised chart of accounts ensures that all financial transactions are consistently categorised, which simplifies tracking income, expenses, and other financial metrics. It is crucial for producing accurate financial reports and making informed decisions.

- Benefits:

- Consistent financial records

- Simplified financial reporting

- Better business insights

- Easier tax preparation

Pro Tip: Customise your chart of accounts to fit the specific needs of your business and industry for better tracking and reporting.

4. Regularly Reconcile Accounts

Regular reconciliation of your bank statements, credit cards, and other financial accounts is essential for maintaining accurate records. This process ensures that the financial transactions in your system match your actual bank activity, helping you detect and resolve discrepancies early.

- Benefits:

- Identifies discrepancies and errors quickly

- Helps prevent fraud or unauthorised transactions

- Enhances financial accuracy

- Simplifies audit processes

Pro Tip: Set up a monthly or bi-weekly reconciliation schedule to ensure that your accounts are always accurate and up to date.

5. Outsource Complex Accounting Tasks

While you can handle basic bookkeeping tasks internally, more complex tasks like tax filing, financial audits, or financial planning may require expert knowledge. Outsourcing these functions to a professional accountant or bookkeeper can help you avoid costly mistakes and ensure compliance with legal regulations.

- Benefits:

- Access to expert knowledge

- Reduced risk of accounting errors

- Frees up time for core business activities

- Ensures tax compliance and accurate reporting

Pro Tip: Work with accountants or firms that have experience in your industry to ensure they understand your business’s unique accounting needs.

6. Implement a Digital Record-Keeping System

A proper record-keeping system is critical for maintaining organised and accurate financial records. Transition to a digital system where you can store invoices, receipts, and other financial documents. This will save space, improve accessibility, and reduce the risk of lost documents.

- Benefits:

- Easy retrieval of documents

- Ensures compliance with financial regulations

- Reduces physical clutter

- Simplifies audit preparation

Pro Tip: Use a cloud-based document management system that integrates with your accounting software to ensure all financial records are stored securely and are easily accessible.

Leverage Odoo ERP for Seamless Accounting Integration

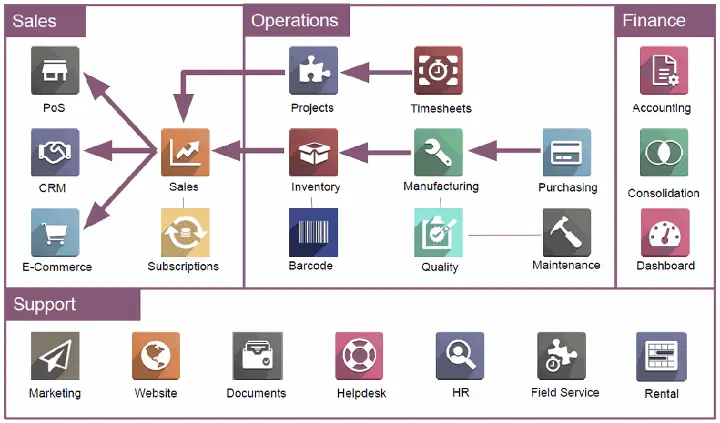

To take your accounting efficiency to the next level, consider integrating your financial processes into a comprehensive ERP (Enterprise Resource Planning) system like Odoo. Odoo offers a robust accounting module that can help businesses streamline all their financial operations in one centralised platform.

Key Features of Odoo Accounting:

- Automation of financial tasks such as invoicing, bank reconciliation, and tax calculation.

- Real-time financial insights and performance metrics for informed decision-making.

- Seamless integration with other business modules like inventory, sales, and HR, creating a unified system.

- Multi-currency and tax compliance features that cater to international transactions.

- User-friendly interface that makes managing accounts easy for non-accountants.

By using Odoo, you can integrate accounting with all your other business functions, ensuring that your financial processes are streamlined, automated, and error-free. Whether you're a small business or a larger enterprise, Odoo's flexibility and scalability make it a perfect fit for businesses looking to simplify their accounting.

Conclusion

Simplifying your accounting processes is essential for business success. By automating repetitive tasks, adopting cloud-based solutions, standardising your chart of accounts, and leveraging powerful tools like Odoo ERP, you can not only improve accuracy but also free up valuable time to focus on growing your business.

Invest in the right tools and strategies today, and watch your accounting efficiency and accuracy improve dramatically.