For Australian businesses, the end of the financial year (EOFY) can be a stressful time. Preparing financial statements, lodging tax returns, reconciling accounts, and ensuring compliance with the Australian Taxation Office (ATO) requirements can overwhelm even the most organised teams. Choosing the right accounting software can make or break your EOFY experience. This article explores why using Odoo Accounting offers a significantly easier, smoother EOFY process compared to MYOB, a traditional favourite among Australian businesses.

Understanding the EOFY Requirements in Australia

Before diving into the software comparison, let's briefly outline what Australian businesses need to tick off their EOFY checklist:

- Reconcile bank and credit card accounts.

- Ensure all expenses and income are accurately recorded.

- Review aged payables and receivables.

- Conduct a thorough stocktake.

- Finalise employee payroll, superannuation, and issue PAYG payment summaries.

- Prepare BAS (Business Activity Statement) and ensure GST is accurately calculated.

- Lodge tax returns and submit necessary financial reports to the ATO.

- Review budgets and plan for the new financial year.

All these tasks require precision, time, and robust software support. Let's see how Odoo Accounting makes this process easier compared to MYOB.

1. Unified Ecosystem vs Legacy Systems

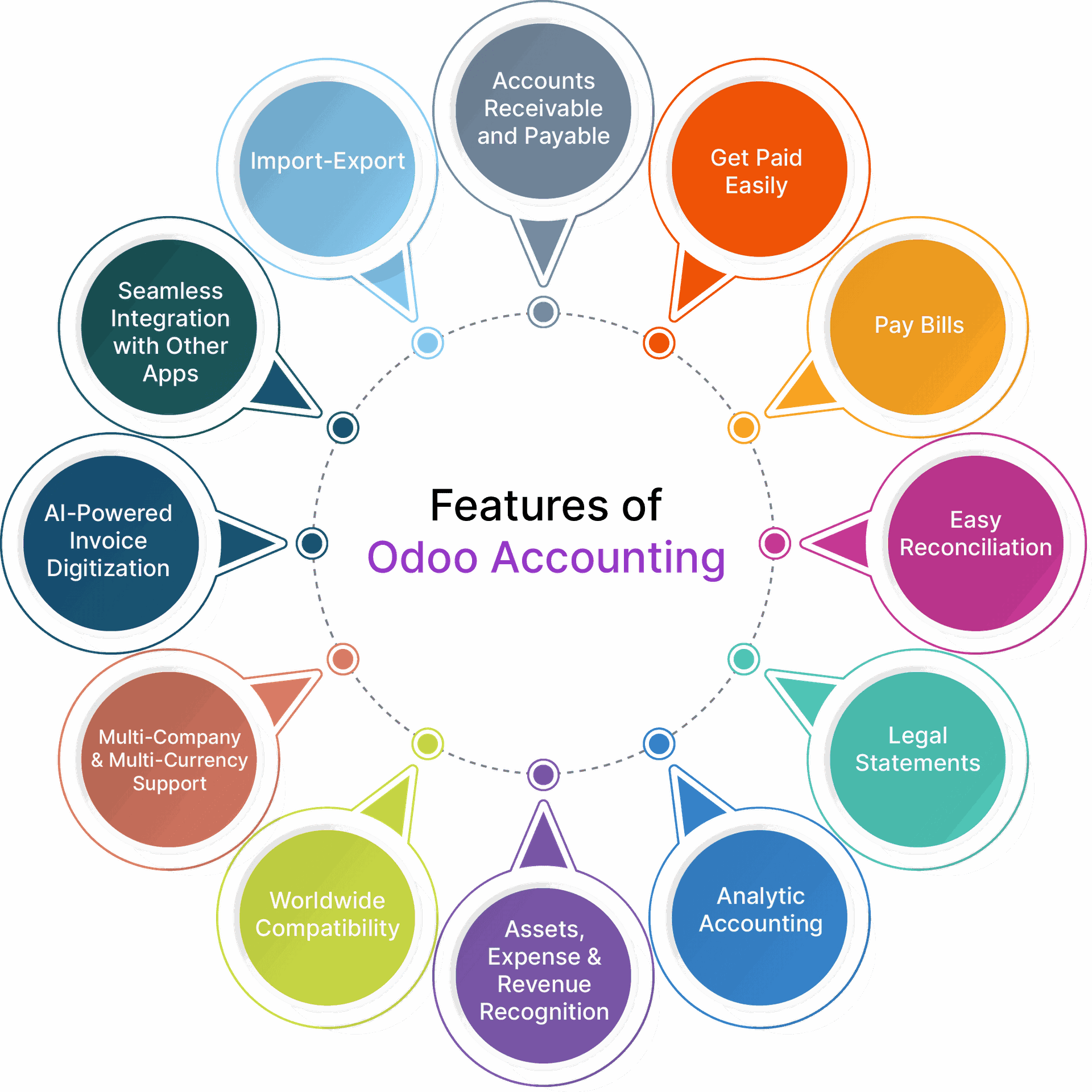

Odoo Accounting is part of the broader Odoo ERP suite, which integrates seamlessly with modules for sales, inventory, HR, CRM, and project management. This unified ecosystem ensures that all business data flows smoothly across departments. For EOFY, this means fewer data silos, fewer manual imports, and a reduced risk of errors.

In contrast, MYOB, while powerful in accounting, often requires integrations or add-ons to handle non-financial data, which can complicate the EOFY process. Users frequently report spending time reconciling data between MYOB and third-party systems.

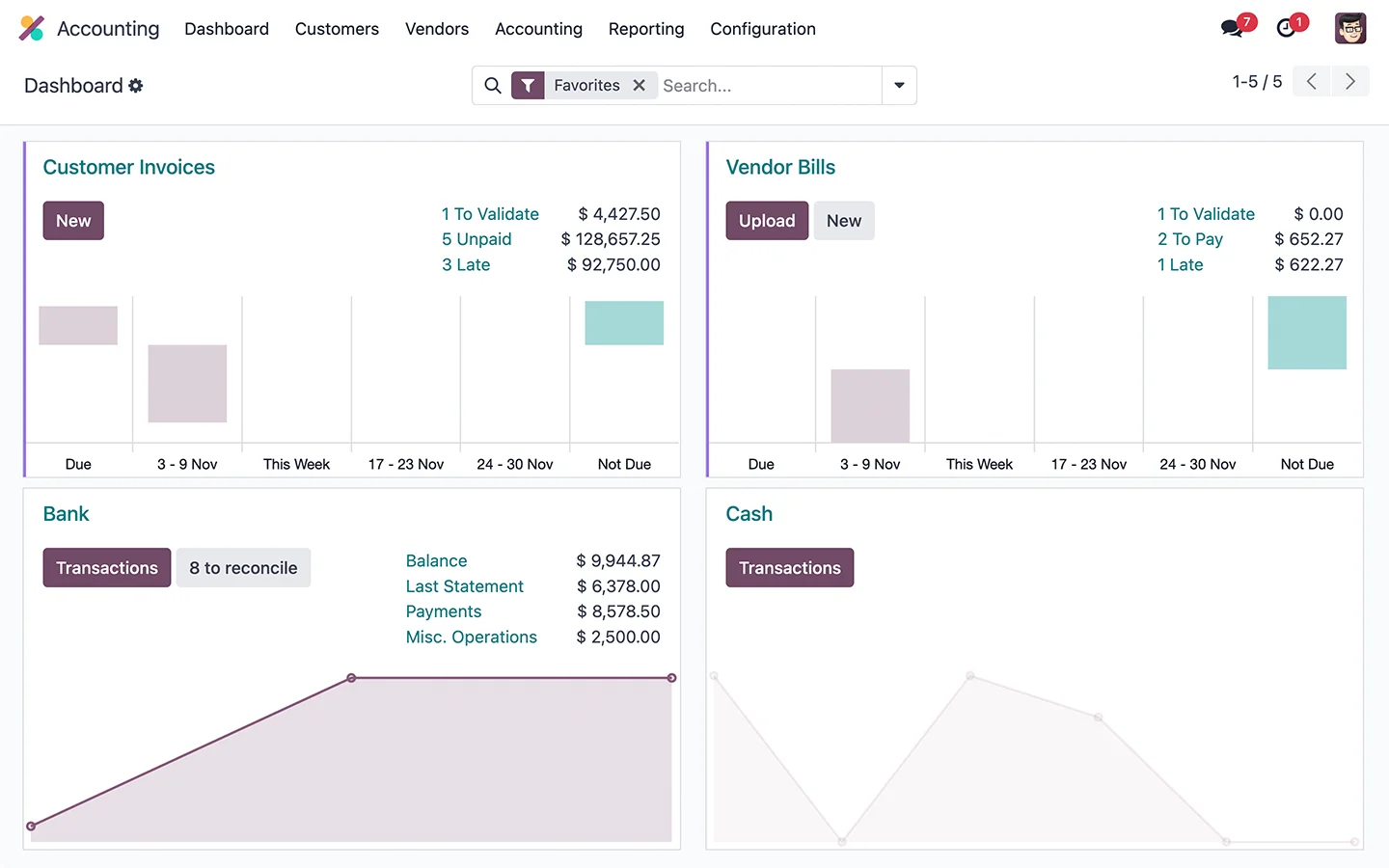

2. Real-Time Reporting and Dashboards

One of the standout features of Odoo Accounting is its real-time financial reporting. With dashboards that update live, you always have a clear picture of your cash flow, profit and loss, and balance sheets. This makes EOFY reviews much smoother, as you’re not scrambling to pull together last-minute reports.

MYOB, while offering robust reporting, sometimes lacks the customisation flexibility and real-time integration that modern businesses demand. Generating tailored reports can require manual setup or external help, delaying EOFY preparation.

3. Simplified Bank Reconciliation

Bank reconciliation is a major EOFY headache for many businesses. Odoo Accounting offers smart reconciliation tools that automatically match bank statements with invoices, expenses, and other entries. The AI-powered suggestions reduce manual work and speed up the process.

MYOB provides bank feeds, but users often note that reconciliation requires more manual matching, particularly when dealing with complex transactions or multiple bank accounts. With Odoo Accounting, the intelligent automation gives you back valuable time at year-end.

4. Streamlined Payroll and Compliance

Australian payroll comes with its own set of complexities: PAYG, superannuation, Single Touch Payroll (STP) reporting, and annual summaries. Odoo Accounting integrates with Australian payroll systems, ensuring that employee payments, tax obligations, and super contributions are calculated accurately and reported seamlessly.

MYOB has strong payroll capabilities, but some users find that managing updates to Australian tax rules or superannuation rates can be cumbersome, particularly across different product versions. Odoo Accounting updates are rolled out centrally, ensuring compliance without the need for manual intervention.

5. GST and BAS Preparation Made Easy

For GST-registered businesses, preparing and lodging the BAS is a key EOFY task. Odoo Accounting has built-in Australian tax support, automatically tracking GST on sales and purchases. The system generates BAS-ready reports, simplifying submission to the ATO.

While MYOB also supports BAS preparation, users sometimes report challenges configuring GST codes or troubleshooting discrepancies between reported and actual figures. Odoo Accounting's clear, user-friendly tax setup reduces the risk of errors and simplifies reconciliation.

6. Inventory Integration for Accurate Stocktake

EOFY stocktakes are essential for businesses holding inventory. Odoo Accounting integrates directly with Odoo Inventory, providing live updates on stock levels, valuations, and movements. This integration ensures that your financial statements reflect accurate inventory values.

In MYOB, inventory management often requires separate modules or third-party apps. Syncing inventory data with financials can introduce reconciliation challenges, adding to EOFY workload. With Odoo Accounting, everything is connected, reducing friction.

7. Automation and Workflow Efficiency

Automation is where Odoo Accounting truly shines. Recurring invoices, automated reminders, smart reconciliation, and scheduled reporting all contribute to a smoother EOFY process. The workflow engine allows you to set up approvals, automate journal entries, and trigger alerts for anomalies.

MYOB has improved automation over the years, but many users still perform critical EOFY tasks manually or rely on workarounds. With Odoo Accounting, the built-in automation reduces manual effort, minimises human error, and accelerates closing books.

8. Customisable Reports for Better Decision-Making

EOFY isn’t just about compliance; it’s an opportunity to reflect on business performance and plan for the next year. Odoo Accounting lets you create custom financial reports, KPIs, and dashboards tailored to your business. You can drill down into specific cost centres, track department-wise performance, or visualise trends over time.

MYOB offers standard financial reports but can be limited in customisation, particularly for businesses with unique reporting needs. With Odoo Accounting, you have the flexibility to shape your reports to support strategic planning.

9. Scalability for Growing Businesses

Australian businesses are dynamic, and software needs evolve. Odoo Accounting scales effortlessly as your business grows. Whether you expand into new markets, add new product lines, or onboard more staff, Odoo’s modular architecture grows with you.

MYOB caters well to small and medium businesses, but as operations become more complex, some companies outgrow its capabilities or need costly upgrades. Odoo Accounting provides a future-proof solution, avoiding the need for disruptive software migrations down the track.

10. Cost Efficiency and Open-Source Advantage

Odoo Accounting is part of an open-source ecosystem, offering exceptional value for money. You pay for what you use, with no hidden costs. Updates, improvements, and community-driven innovations continually enhance the system.

MYOB, operating on a proprietary model, often involves tiered pricing, add-on costs, and additional fees for premium features. With Odoo Accounting, you get a cost-effective solution that delivers powerful functionality without breaking the bank.

Why Odoo Accounting Wins at EOFY

Summing up, here’s why Odoo Accounting is the clear winner for Australian EOFY preparation:

- Integrated ecosystem reduces silos.

- Real-time dashboards enhance visibility.

- Smart reconciliation and automation speed up processes.

- Built-in compliance keeps you ATO-ready.

- Custom reports support better decision-making.

- Scalable, cost-effective, and future-proof.

While MYOB remains a strong contender, especially for traditional setups, Odoo Accounting brings modern, agile, and automated solutions that take the pain out of EOFY.

Final Tips for Your EOFY Success

Even with the best software, it’s important to follow best practices:

- Start your EOFY prep early.

- Schedule time to review all reconciliations.

- Engage your accountant or bookkeeper for an external review.

- Use Odoo Accounting to generate predictive reports and set next-year budgets.

- Keep software and compliance updates current.

Ready to Simplify EOFY with Odoo Accounting?

If you’re looking to make your next EOFY stress-free, it might be time to switch to Odoo Accounting. With its robust automation, real-time insights, and seamless Australian tax compliance, Odoo Accounting empowers businesses to close the books faster, with fewer headaches.

Get in touch with an Odoo partner in Australia today to see how Odoo Accounting can transform your EOFY process — and your entire financial workflow.

Remember, EOFY doesn’t have to be a nightmare. With Odoo Accounting, you can turn it into an opportunity for growth, strategy, and success.