For small and medium-sized enterprises (SMEs) in Australia, choosing the right accounting software can significantly impact efficiency, compliance, and long-term growth. Two powerful platforms stand out in this space: Xero, a New Zealand-born favourite tailored to Australian tax and compliance standards, and Odoo, an open-source ERP platform offering an integrated financial module as part of its comprehensive business suite.

While both tools serve vital needs in the SME segment, they differ in approach, capabilities, and long-term value. In this article, we'll explore a fair comparison of Xero and Odoo for Australian businesses—highlighting use cases, strengths, limitations, and ultimately making a case for Odoo's relative advantages for growing organisations.

Read More : NetSuite vs Odoo

Overview of Xero and Odoo

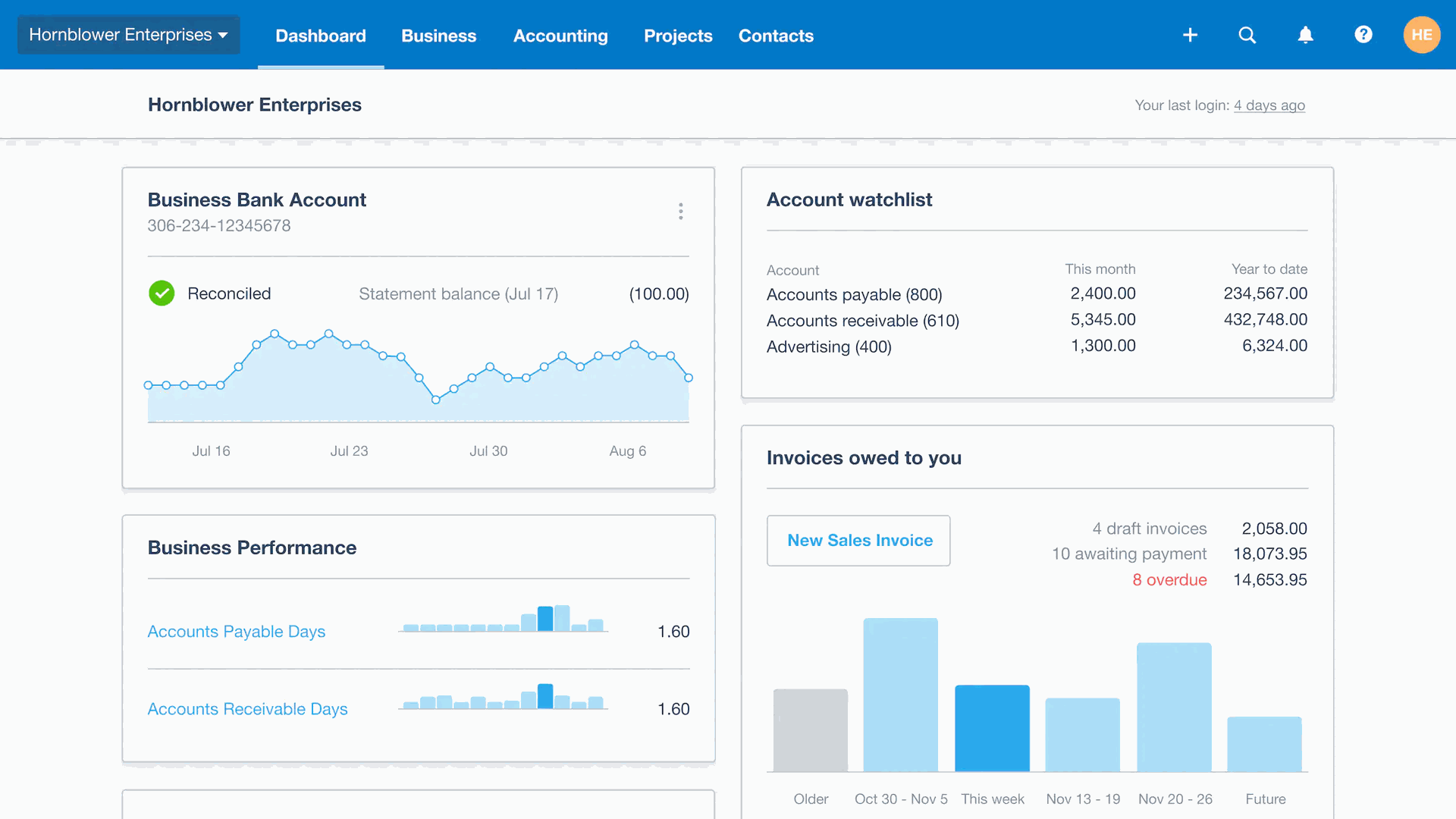

Xero is a cloud-based accounting solution that has gained massive popularity among Australian SMEs for its simplicity, excellent UX, and strong integration with local financial and tax systems. It’s known for its plug-and-play nature, allowing small businesses to handle invoicing, bank reconciliation, BAS, payroll, and reporting with minimal setup.

Odoo, by contrast, is more than just an accounting tool. It's a modular ERP system that offers financial management as part of a larger ecosystem—including CRM, inventory, HR, manufacturing, and more. The Accounting module in Odoo is powerful and versatile, capable of supporting complex financial operations when configured properly.

Features Odoo VS Xero: Side-by-Side

| Feature | Xero | Odoo |

|---|---|---|

| Invoicing | User-friendly, compliant with Australian tax laws | Fully customisable with automation capabilities |

| Bank Feeds | Real-time sync with Australian banks | Available via third-party connectors or custom integration |

| Payroll | Built-in, ATO-compliant | Via dedicated apps or integrations like Odoo Payroll (with configuration) |

| BAS/GST Reporting | Native support | Requires localisation (available through partners) |

| Custom Reports | Limited in standard plan | Highly customisable with full control |

| Multi-Company Support | Limited | Built-in and robust |

| Scalability | Great for small businesses | Excellent for growth and multi-departmental needs |

| Third-party App Integration | Strong app ecosystem | Open-source API and large module ecosystem |

Read More : Odoo vs GHL

Localisation and Compliance for Australian SMEs

Compliance is critical for Australian businesses. Xero has the upper hand in out-of-the-box compliance—it supports Australian payroll, GST, BAS lodgement, and ATO reporting with native features. This ease of use makes Xero ideal for startups and micro businesses that want to get running quickly.

Odoo, while not pre-configured for Australian tax systems, has extensive localisation support through partners and community modules. For example, Odoo can be customised to handle:

- Australian GST

- BAS reporting

- Single Touch Payroll (STP) via integration

- ATO documentation standards

With the right implementation partner, these features can match or exceed Xero's built-in offerings.

User Interface and Ease of Use

Xero shines in this category with its clean, modern UI and focus on non-accountants. It’s designed for business owners and operators who need to manage books without deep financial knowledge.

Odoo, although slightly more complex out of the box, offers a highly intuitive UI once users are familiar. The flexibility to customise dashboards, workflows, and automations makes it extremely powerful, especially for businesses growing in complexity.

Read More : Odoo CRM vs HubSpot

Integration and Automation

Xero boasts a robust marketplace with hundreds of third-party integrations tailored for Australian users—from POS systems to payroll add-ons.

Odoo’s open-source framework allows for deeper integration and automation. Businesses can connect every aspect of their operations in a unified system—from sales and inventory to finance and HR. This tight integration often reduces redundancy, improves efficiency, and provides better visibility across departments.

Scalability and Long-Term Value

One of Xero’s main limitations is scalability. As companies grow, they may find themselves requiring more robust ERP features such as advanced inventory, project management, or multi-company accounting—forcing them to patch together several tools.

Odoo is built with scale in mind. As a full ERP solution, it grows with your business. Whether you’re managing five employees or five hundred, Odoo’s modular structure ensures you can add functionalities without switching platforms.

Read More : EOFY Checklist - Easier with Odoo Accounting

Pricing Comparison

Xero operates on a subscription basis with tiered pricing. While affordable initially, costs can add up as more features and users are needed. Additional modules or integrations (e.g., payroll or time tracking) may incur extra charges.

Odoo offers a flexible pricing model: you pay for the apps you need and the number of users. The community version is free, while the enterprise version offers premium support and cloud hosting. For growing businesses, this pricing structure often provides better ROI.

Read More : 7 Essential EOFY Reports for Australian Businesses

When to Choose Xero

- You run a small business with basic accounting needs

- You prefer an off-the-shelf solution with minimal setup

- Compliance and local tax reporting are your top priority

- You don’t need complex inventory, CRM, or manufacturing features

When to Choose Odoo

- You anticipate growth and need a scalable system

- You want to integrate accounting with other business processes

- You require custom workflows or advanced reporting

- You need multi-company or multi-currency support

- You’re ready to invest in a long-term ERP solution

The Final Verdict

Both Xero and Odoo are excellent platforms, but they serve different business needs. Xero is ideal for startups and small businesses looking for ease of use and fast local compliance. Odoo, on the other hand, offers more flexibility, customisation, and long-term scalability—making it the smarter choice for SMEs planning for growth and integration.

With the help of a qualified implementation partner, Odoo can match—and in many cases surpass—Xero’s accounting capabilities, while providing a full ERP backbone for broader business management.

Partner with Moonsun: Australia’s Trusted Odoo Experts

At Moonsun.au, we specialise in helping Australian businesses unlock the full potential of Odoo. As an official Odoo Partner in Australia, we provide end-to-end implementation services—from localisation and setup to custom module development and training.

If you’re currently using Xero or another platform, we also offer Odoo migration services—ensuring a seamless transition with minimal disruption to your business. Whether you're just starting or scaling rapidly, our team ensures Odoo is tailored perfectly to your operations.

Ready to transform your business with Odoo?

Visit moonsun.au or contact us today to book a consultation.